Financial technology companies such as Robinhood Markets Inc. and Revolut Ltd. are exploring the launch of their own stablecoins, betting that stricter regulation in Europe and other regions will ultimately weaken Tether Holdings Ltd.’s grip on the rapidly expanding $170 billion digital asset space.

Sources familiar with the matter say that Robinhood and Revolut, two of the most valuable fintech companies, are experimenting with issuing their own stablecoins, but the companies may still choose not to proceed. They requested anonymity to discuss confidential information.

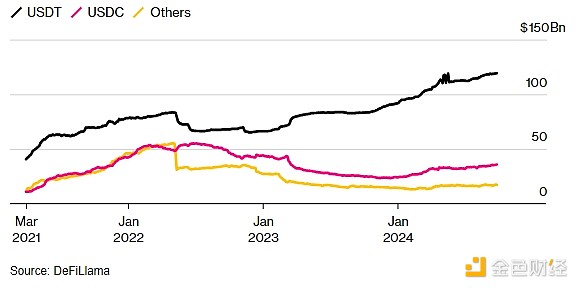

For years, upstarts have tried to compete with Tether’s USDT, but most have met with little success. Stablecoins, which are tokens designed to maintain a constant value, have swelled to a market capitalization of nearly \(1200 billion, more than two-thirds of the market. The second-largest, USDC, has a market cap of \)360 billion, according to CoinGecko, while other stablecoins are much smaller.

But Tether faces increased uncertainty as the European Union prepares to fully adopt broad cryptocurrency rules by the end of this year. Under the MiCA regulation, cryptocurrency exchanges operating in the EU could be forced to delist stablecoins issued by firms like Tether that have not obtained appropriate licenses.

USDC issuer Circle Internet Financial Ltd. has already secured the necessary EU license. The company said in January that it had secretly filed for an initial public offering in the United States.

Tether’s CEO, Paolo Ardoino, has repeatedly expressed concerns that EU rules would pose too much risk if stablecoin issuers face large-scale redemptions. The company, which doesn’t have an e-money license in the EU, is developing a “technology-based solution” to serve the bloc, Ardoino said in an emailed statement.

A Robinhood spokesperson said the company has “no plans to launch that product in the near term.” A Revolut spokesperson said the company plans to “further develop” its crypto product suite but wouldn’t confirm a future stablecoin.

The financial incentives are considerable. Tether’s profits come primarily from the reserves backing USDT, which reached $5.2 billion in the first half of 2024, as the circulating value of USDT rose in line with interest rates, according to Tether data. The company said it had about 100 employees as of the end of the period.

“There are many companies that have looked at companies like Circle and Tether and the data they’ve published,” said Thomas Eichenberger, chief product officer at Swiss crypto bank Sygnum, in an interview. “It looks like a great business model, and there are probably a lot of people who would like to replicate it.”

There are also early signs that stablecoins, which have thus far primarily served as tools for moving funds into and out of cryptocurrency exchanges, are being used more broadly for payments. For example, Russian companies are using USDT to pay for imports, circumventing a banking system hobbled by sanctions.

Almost half of cryptocurrency users in emerging markets such as Brazil, Indonesia, Turkey, India, and Nigeria are buying stablecoins to save in U.S. dollars, according to a survey this month by Castle Island Ventures, Brevan Howard Digital, and Artemis. Nearly 40% use stablecoins to pay for goods or services, and more than one-fifth receive or pay salaries in these tokens.

As more issuers enter the market, the result could be “a high degree of stablecoin fragmentation,” said Nuri Chang, product lead at BitGo, which announced its own token in September. He said different financial applications might run their own stablecoins, and the exchange between those tokens would become so seamless that end users might not even notice.

“Mainstream retail brands, new banks, and exchanges will consider issuing stablecoins. So will credit card companies,” said Christian Catalini, founder of the MIT Cryptoeconomic Systems Lab. “People are starting to realize that Tether and Circle have a huge amount of power in this market.”

USDT has remained resilient in the face of various challengers over the years. PayPal Holdings Inc. launched a stablecoin last year, attempting to solidify its dominance in digital payments. The token’s circulating supply peaked at $1 billion in August but has since declined by about 30%, according to CoinGecko.

Under MiCA’s first stage, the EU rules governing stablecoins entered into effect at the end of June. They require stablecoin issuers to hold an e-money license in an EU member state, hold up to two-thirds of the tokens’ backing assets in independent banks, and meet other standards.

The EU’s implementation period for all other crypto platforms — from exchanges to funds — runs for up to 18 months, beginning at the end of 2024. This two-stage approach allows for the formation of a compliance gray area, where the stablecoin rules are in effect but exchanges aren’t necessarily required to remove noncompliant tokens until they obtain their own MiCA license.

Exchanges including OKX, Uphold, and Bitstamp have already partially delisted Tether stablecoins ahead of the looming deadline. Crypto payment business BVNK’s chief commercial officer Chris Harmse said these platforms are now at a “competitive disadvantage,” and his company intends to keep Tether on its EU platform until the regulatory picture becomes clearer.

SG-Forge, a unit of Societe Generale, is one company that sees an opportunity. The firm said in July that it had secured an e-money license and has expanded its stablecoin into the retail market.

“We believe the stablecoin market — certainly in Europe, but possibly across the world — will be reshaped by MiCA,” Stenger said. “There’s now a very high demand for clean products.”

流光渐逝

回复This article is really insightful. It looks like the stablecoin market is about to get a lot more competitive with companies like Robinhood and Revolut entering the scene. It will be interesting to see how Tether responds to this increased competition and how the EU's MiCA regulations shake things up. This article definitely gave me a better understanding of the evolving landscape of stablecoins and the potential for new players to disrupt the market.

SilentKnight

回复This is an interesting article about the growing competition in the stablecoin market. I'm particularly interested in the potential impact of MiCA regulations on Tether's dominance. It will be interesting to see how these new regulations shape the market and whether we'll see a fragmentation of stablecoins, as some experts predict.

PhantomRider

回复This article is a great insight into the evolving landscape of stablecoins, particularly with the EU's MiCA regulations coming into play. It's interesting to see how companies like Robinhood and Revolut are positioning themselves amidst the regulatory uncertainty, while others like Circle are actively pursuing compliant solutions. The potential fragmentation of the stablecoin market is intriguing, and it's worth considering the implications for both users and the overall cryptocurrency ecosystem.

DarkHunter

回复Interesting article! It seems like the stablecoin market is heating up, especially with new regulations coming in. It's good to see companies like Robinhood and Revolut considering their own stablecoins, and I'm curious to see how this all plays out.

风中飘零

回复It's interesting to see how the landscape of stablecoins is shifting with increased regulations. If Robinhood and Revolut enter the market, it could create a more competitive environment and potentially weaken Tether's dominance. I'm curious to see how this plays out in the EU, especially with the upcoming deadlines for compliance.